We get it, not everyone is ready to tackle budgeting, debt management, home buying and investing all into one step…and thats ok! We recognize that timing is everything, and taking is slow is never a bad thing. We have put together the foundational pieces from EmpowHer into one small easy to digest foundational lab.

When you are ready EmpowHer 2.0 will be waiting for you (with a nice discount!)

By the time you finish this course, your life will look a lot different. Imagine the below is YOUR new reality:

Your budget is set and working for you. Every month you know exactly how much you are spending on expenses, entertainment and investing. Every quarter, you check in and see if things have shifted. If so, a couple quick tweaks get you back on track.

Your debt is getting smaller and smaller. You know exactly which debt to pay off first and how much to pay each month. You have a PLAN and a timeline. Bills come in but don’t cause the panic they used to. You’ve GOT THIS.

You know EXACTLY how credit cards work, how to analyze your statements and how to know when you are digging yourself int a deeper hole. You know how debt can be used as a tool, and you are excited to take charge of your spending power.

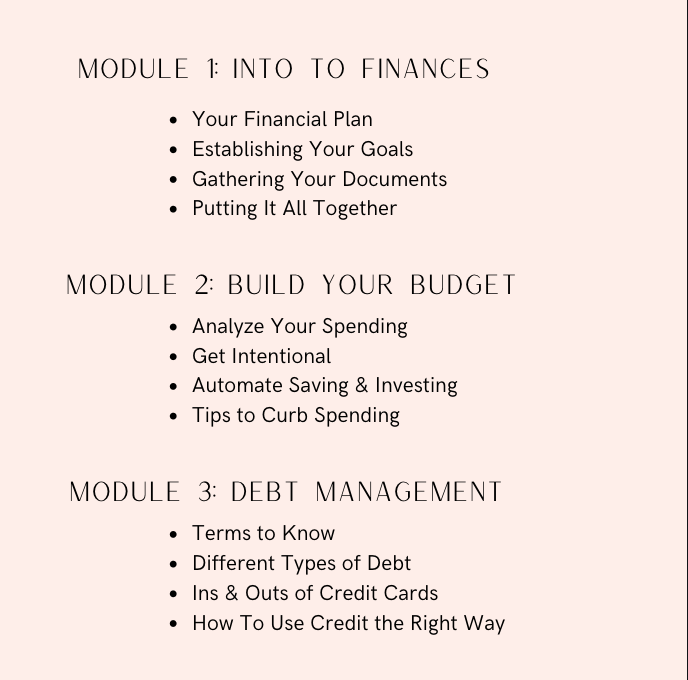

Intro to Personal Finance & Budgeting

What you’ll learn

Meet Ashlee

Ashlee is a business owner, real estate investor, mother and self taught finance aficionado. Her no b.s. attitude and a passion for helping other women thrive brought her and you to this corner of the internet.

Testimonials

FAQs

What if I have ZERO budget or money skills?

Perfect, then you’ve come to the right place. We start at square one, and will cover EVERY part of building a budget. From how to collect the data, how to organize it and how to track it (in your BONUS budget template) we will cover it all.

What if I have a ton of debt?

Then we are SO glad you are here. We have multiple strategies for how to pay off debt, how to understand different types of debt, how to read credit card/loan/bank statements and more.

Will this only work if I have a lot of extra money?

Nope, even if all you can do right now is make minimum payments or save as little as $5 a month we will show you how to prioritize what to pay off first, what to save for first and how to know when it’s time to change your strategy.

I’ve tried budgeting before, how is this different?

A lot of people know WHAT to do, but they don’t know HOW to do it. This isn’t just a fancy list of what to do, this is an in depth guide on exactly HOW to take these steps. We cover multiple scenarios and multiple strategies for how to accomplish your goals.

What else do you cover?

Understanding how to leverage debt is an important skill in the wealth building journey. We cover how to analyze interest rates, understand APR, grace periods, repayment terms and more. Utilizing debt to your advantage is a skill that most people are missing, but you wont be one of those people!

What comes next?

Once your Budget, Debt Payoff, Savings and Financial Plan is in place, then the growth begins. When you are ready to start investing, saving for retirement, leveraging your money and growing your wealth EmpowHer 2.0 will be waiting for you (with a nice discount!)

Enroll Now

Enroll Now

Limited Time Only

Your full financial foundation covering budgeting, managing your monthly cash flow, debt payoff and utilization, how to understand credit and more!

Still have Questions?

Enroll Now

Enroll Now

Limited Time Only

Your full financial foundation covering budgeting, managing your monthly cash flow, debt payoff and utilization, how to understand credit and more!

Freebie!

Financial Jargon is more than just a buzz kill, it’s a massive barrier to financial stability. How are you supposed to grow your wealth if you don’t even understand the lingo? This is NOT your fault, our education system just doesn’t teach this stuff. The foundation is the most important step, and I am going to give you the most important pieces to get you started. Download this guide and SAVE it, you’ll use it as your reference for years to come.

85 Finance Terms Every Woman Needs to Know

Freebie!

Find Your First $5,000

We get it, building a 7 figure net worth can feel like an impossible task. As women, we fill many roles (friend, daughter, sister, wife, mother, boss to name a few) and who has room left on their plate for financial stress? You don't, and thats why we are here!

In this free guide, we will start you out with 50 ways to find your first $5,000 to save and invest WITHOUT having to work harder, just smarter.

Your foundation is the most important step in the financial stability journey. By the time you finish this program, your life will look a lot different. Imagine paying off your debt (stress), locking in your budget (control) and beginning your wealth building journey (growth).

Intro to Personal Finance & Budgeting

Welcome to the robust 6 module full financial plan spanning over 120 pages filled with insights, strategies and actionable steps to fully encompass your financial goals and move you towards a 7 figure net worth.

This is unlike anything you have tried before, designed as the singular resource to guide you from financial confusion to proficiency. It will bring about a transformative shift in your life within just a few months.